Selected Industry Overview Slides

Electronic Manufacturing Services (EMS)

Electronic Manufacturing Services companies (EMS) build products as specified by their customer – an Original Equipment Manufacturer (OEM). Unlike OEM’s, EMS companies do not own product designs or sell products under their own brand.

EMS companies build printed circuit board assemblies (“PCBA”), mechanical sub-assemblies and complete end-products. EMS sites do “PCBA-only” production work for certain customers, and “box-build” work for other customers where the PCBA’s are then integrated with plastic, metal and other mechanical parts for complete product build. Other services offered by EMS companies include product design, test design, field return repair, warehousing and distribution.

EMS companies often create customer focus teams to support individual customers service needs. Teams typically include program manager, project and process engineers, production planners, component and quality engineers, and others as needed. Depending upon the size of the program these positions are either dedicated full-time or shared. Warehouse space, production floor space and certain equipment are usually dedicated to individual customers.

The typical EMS site has a dozen or more customers, each with multiple products, fluctuating demand forecasts, frequent product changes and annual new product introductions (“NPI”). Effective and efficient materials management systems are key to an EMS company’s success.

Major Competitors

The EMS industry is highly competitive. Foxconn, Flex and Jabil are by far the largest in sales revenue and global facilities. Besides these top-40 there are several hundred other smaller, mostly regional and often specialized companies.

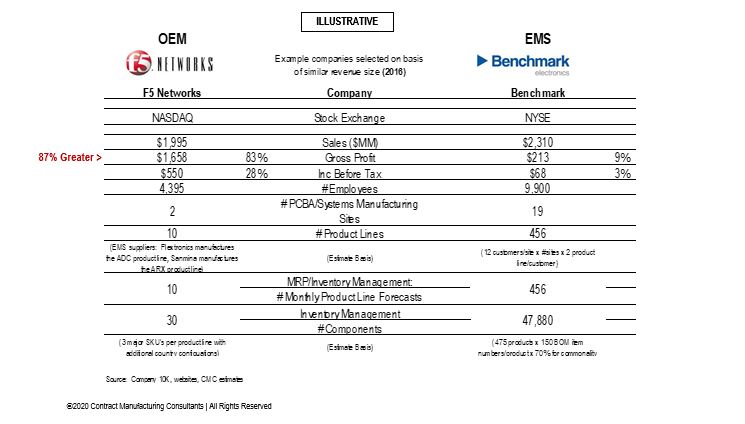

EMS vs. OEM Companies

Electronic equipment OEM’s generally have far higher profit margins than EMS companies, in the example below 83% vs. 9%. Supply chain management is far simpler for an OEM outsourcing their manufacturing, in the example below 30 parts (procured finished products) vs. about 45,000 component parts for an EMS company.

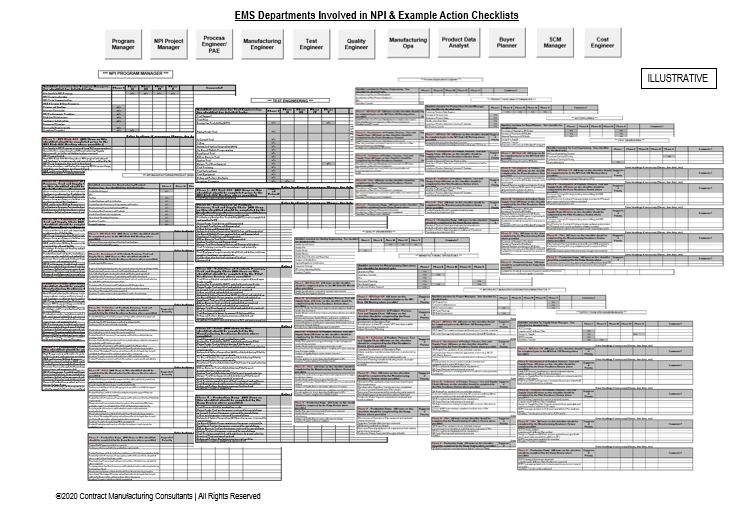

New Product Introduction

NPI is key to an EMS company’s growth but most sites can only manage a couple of new programs a year. Considerable effort is required in planning and resourcing. EMS companies rely on future sales to recover these largely uncompensated upfront costs.

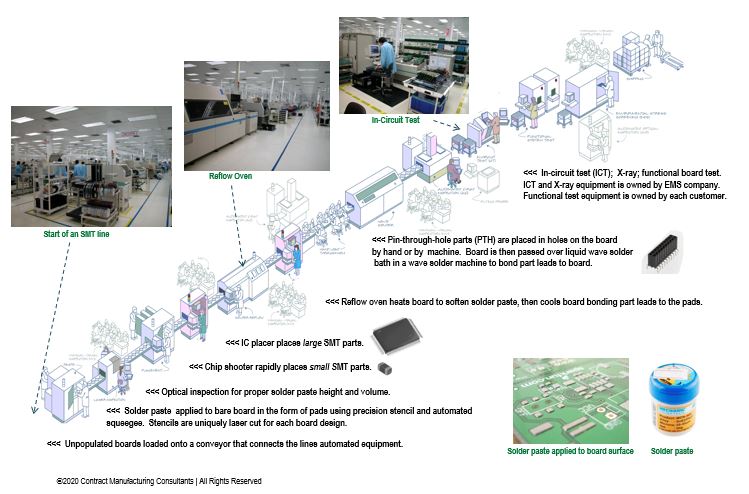

Printed Circuit Board Assembly Process

The development of Surface Mount Technology (SMT) on printed circuit boards allowed for the rapid assembly of electronics.

Mechanical-build (“Box-build”) Assembly Process

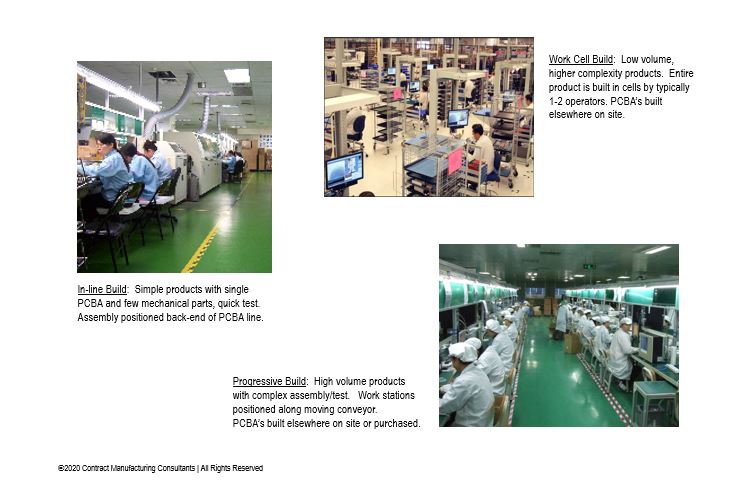

Box-build assembly process depends on production run rates, assembly and test complexity.

Product Complexity - Box-Build

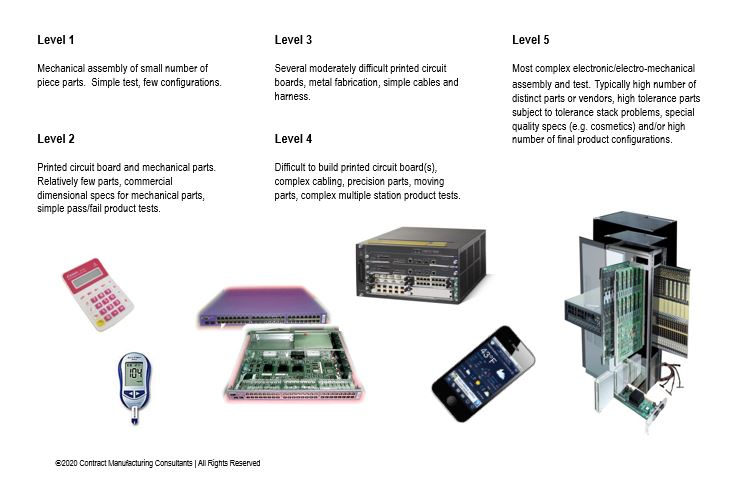

Mechanical assembly (“box-build”) complexity is on a 1-5 scale where Level 5 is most complex.

Components & Suppliers

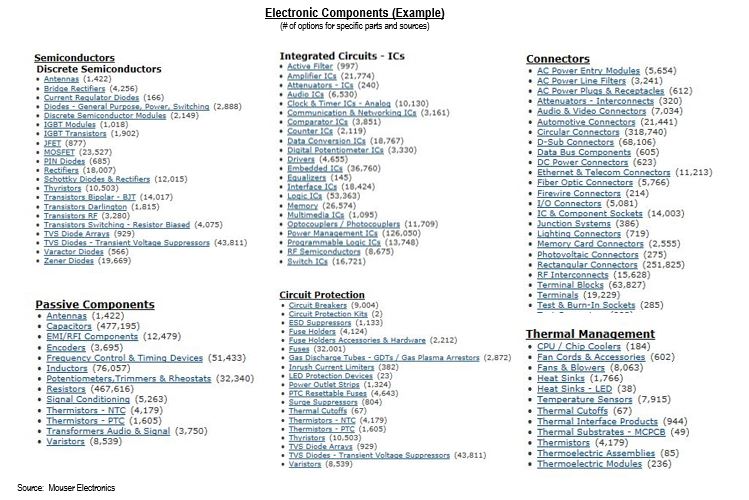

EMS companies manage tens of thousands of electronic and mechanical parts from many suppliers. The table below shows a sample of electronic part types available from many distributors.

Parts Warehouse

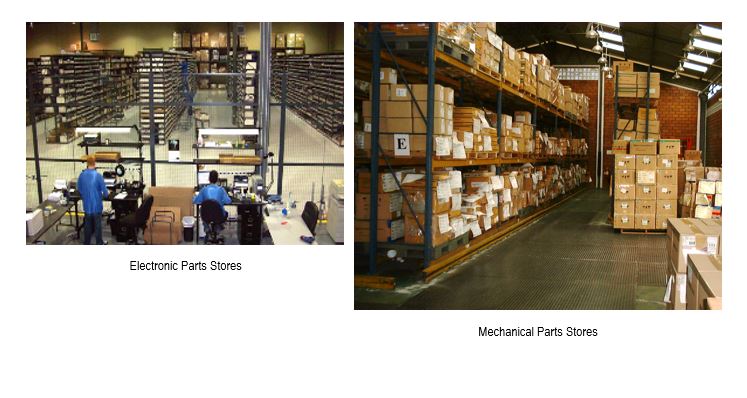

Electronic parts (e.g., bare boards, actives, passives, connectors) are stored separately from mechanical parts (e.g., plastics, metals, packaging, hardware, electro-mechanical sub-assemblies. Mechanical parts require far more warehouse floor space than the small electronic parts, particularly plastic and metal parts often stored on pallets.

Inventory & Configuration Systems

There are a number of key sub-systems that require very high levels of accuracy to order to meet product demand and latest revision specifications, and to minimize potential excess inventory.

- Inventory Control Sub-Systems -

- Product Configuration Sub-Systems -

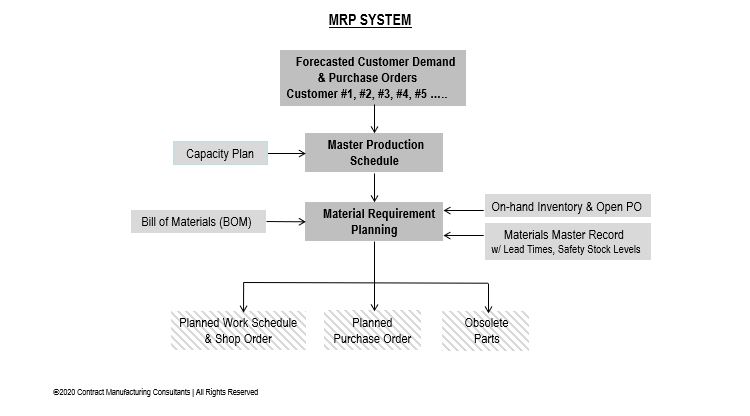

Materials Requirements Planning

MRP software helps ensure parts are available to meet customer product demand and that inventory levels are aligned with vendor lead-times. Primary output is a master production plan which incorporates capacity limits and a materials requirement plan which incorporates on-hand inventory, open orders, vendor lead-times and safety stock levels for each part on the bill of material (BOM). The system is commonly run over a weekend to generate buyer action lists for the following week. Buyer actions include placing purchase orders for parts at vendor lead-time; also placing change orders to either accelerate deliveries (”pull-ins”) or delay deliveries (“push-outs”) depending if and how demand forecast has changed since last iteration.